For years the Internet and the alternative media including Zero-hedge’s Tyler Durden WARNED in 2014 that Deutsche Bank debt was $75 Trillion In Derivatives or 20 Times Greater Than the German GDP.

Deutsche Bank has never been able to recover from the first financial crisis.

Now experts and the IMF are warning those derivative bubbles could pop. Big enough to bring down the entire European financial system as we warned prior to Brexit. The Brexit vote could bring down the British Pound Sterling and the European Union.

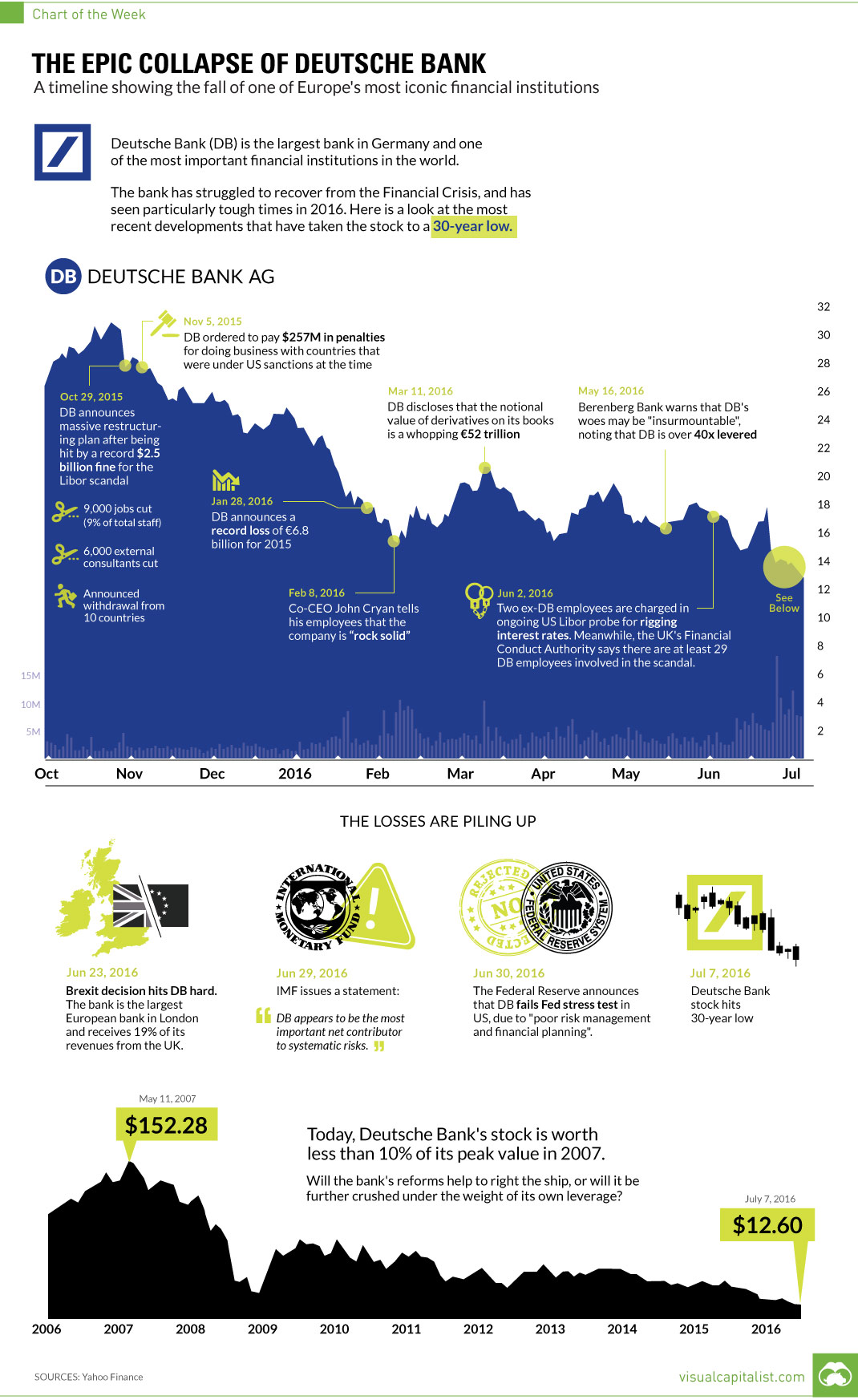

Decushe Bank also failed a test of financial strength administered early in the year by the IMF. The U.S. Fed also expressed concerns early last month in June, about the stability of the German Bank when Deutsche Bank failed the Fed Reserve’s Annual stress test. Causing Deutsche Bank shares to fall to a 30 year low.

Italian Prime Minister Matteo Renzi has even talked about Deutsche Bank calling it insolvent.

“If this non-performing loan problem is worth one, the question of derivatives at other banks, at big banks, is worth one hundred. This is the ratio: one to one hundred”

~Italian Prime Minister Matteo Renzi said.

The Italian Prime Minister Matteo Renzi isn’t the only one to call Deutsche Bank insolvent

RT’s Max Keiser and former Wall St banker has previously also called Deutsche Bank Insolvent and a Ponzi Scheme.

Deutsche Bank shares have previously fell 40% back in February, after Brexit and failing a stress test shares have fell more to a low of 50% that’s worse then when the Lehman brother collapse happened. Falling below their price at the time of the 2008 financial crisis this chart is from February just to show the down fall of Deutsche Bank. Deutsche Bank receives 19% of its revenues from the UK so it’s hurting

from Britain’s exit from the European Union.

The Deutsche Bank crash just got historic. THIS happened today. $DB: https://t.co/mQsbPRkaId pic.twitter.com/bPFF0PCIqG

— StockTwits (@StockTwits) February 9, 2016

Is this a sign of whats to come? Deutsche Bank has been propped up on fraud for years and now it seems without that fraud it can’t withstand the markets and investors. Deutsche Bank CEO has even expressed uncertainty that Deutsche Bank will even make a profit this year. In October 2015, Deutsche Bank said they would cut 35,000 jobs, and exit 10 countries.

“We’ve said this year is not going to be a profitable year, we may make a small profit, we may make a small loss, we don’t know,”

John Cryan, Deutsche Bank CEO said.

Now David Folkerts-Landau, the chief economist of Deutsche Bank, has called for a multi-billion dollar bailout for European banks yesterday. This again seems like another sign that we are headed for another Economic Collapse event that according to several economist including Jim Willie that will be way worse.

We will continue to keep you up to date on the collapse of Deutsche Bank.

If you are interested in looking into this more visual capitalist provided a good insight into the epic collapse of Deutsche Bank.

The post IMF: Deutsche Bank World’s Most Dangerous Bank Shares HALVED appeared first on We Are Change.

from We Are Change http://wearechange.org/imf-deutsche-bank-worlds-dangerous-bank-2/

No comments:

Post a Comment