This is Luke Rudkowski of WeAreChange and today we have the one and only Max Keiser. He is a good friend of mine although we haven’t spoken in a while.

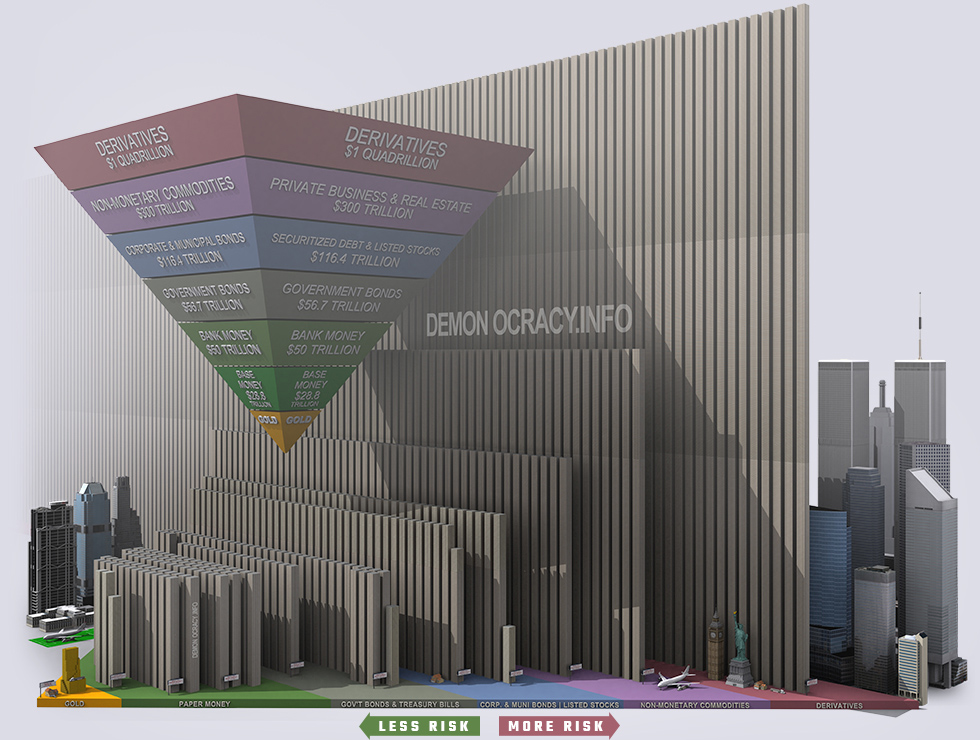

The last time we talked we discussed the financial system within the United States. With the debt now passing 20 trillion dollars and all of the many bubbles out there. Bubbles like the bubbles in derivatives, student loans, and the real estate bubble. You’ve been covering the finances of the world for a very long time. The last time we talked about what kind of economic troubles you see as a major problem for the United States? It seems like only a matter of time before these bubbles catch up with us.

Video is also available on DTube

Max Keiser:

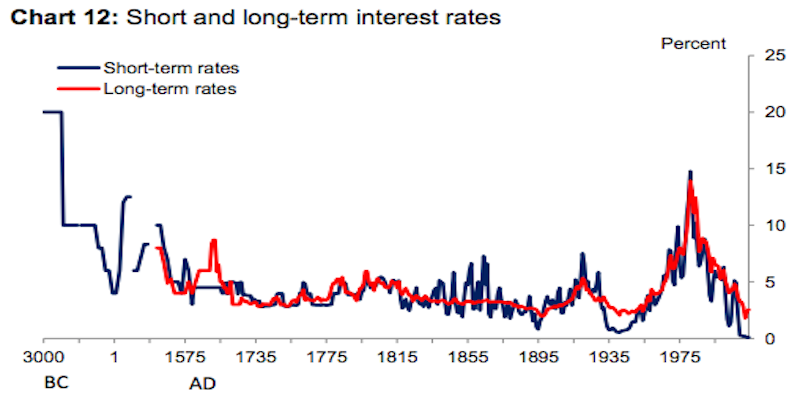

I would say the number one bubble today is the bond bubble. Let me explain a little bit about what I mean. There is the sovereign government bond market, and it is trading at multi-hundred-year highs. In America, we haven’t seen bonds trade at this high of a level in 240 years. This is the same for Great Britain which has not seen bonds trade at these levels in over 300 years. The inverse of this bond price bubble is interest rates.

Interest rates are at historic lows because the central banks are in the business of keeping their brethren banks from having to declare insolvency. They do this by buying from them all the junk on their balance sheets. So whenever these banks accumulate some nasty asset, they then sell it to the central bank, and they store it for them. That’s how you get to that four point five trillion dollars worth of assets on the Federal Reserve balance sheet.

Then Janet Yellen will go on TV, and she’ll talk about this need “to unwind these assets” meaning we’re going to start selling these assets. However, that’s impossible because that would mean interest rate would need to start creeping up. That means that all the efforts to keep these banks from declaring insolvency would fail. They’d have to start reporting that they are insolvent. All the major banks in the US, Deutsche Bank, big European banks, along with all the banks in the UK are all technically insolvent. They must keep interest rates low.

Many people say that a bubble that will burst and that it’s only a matter of time. I have an alternative hypothesis; there’s another possibility. What we see in the U.S. is effectively the entire stock market being taken private. There are a lot of leveraged buyouts on Wall Street. That is where one company buys another company using debt by pledging the assets of the company they’re going to acquire as the collateral for the loan. They then buy the company, and once they own it, they start selling off the assets to pay back the loan. That’s a leveraged buyout, and this is easy in an environment like today where interest rates are near zero. They can borrow billions and billions, and billions of dollars and the interest costs on this is almost nothing.

There’s no regulatory monitoring this, so no one’s stopping any of these deals from occurring. The media business is consolidated down at just two or three players and its the same in the banking business. There is now just a few players in all verticals of American industry. It’s all narrowed down to just two or three players from this ongoing process of consolidation of buying everyone out.

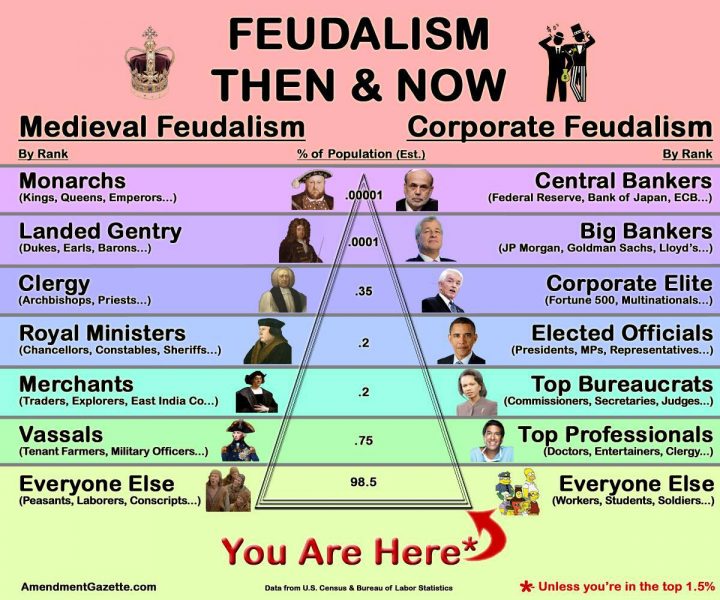

We’re at a point where the entire market is at risk of being taken private with no publicly listed stocks of any consequence available. That could be the end game. Instead of a bond collapse occurring with interest rates spiking and a normalization period we could get something entirely different. We may be looking at a situation where all the assets are held and totally in control of a tiny minority of players. Where they control the entire Monopoly board.

That would mean that wealth and income gap levels will stretch to feudalist lord levels. You’ll have fiefdoms, and you will have serfs. In a way, you already have the prison industrial complex that is paving the way for this. The average American already has less than 100 bucks in savings and are one paycheck away from insolvency. The health care costs are beyond the reach of just about everybody. The prices are not commensurate with a well-educated population. So all the pumps are being primed, and that’s what I see as the endgame.

So is it a bubble well, yes. This alternative outcome could take hold with the most extreme form of wealth and income gap you can imagine. Essentially medievalism is in the cards. Unless there is a trend reversal, otherwise we’re heading toward Lords and Serfdom.

Luke Rudkowski:

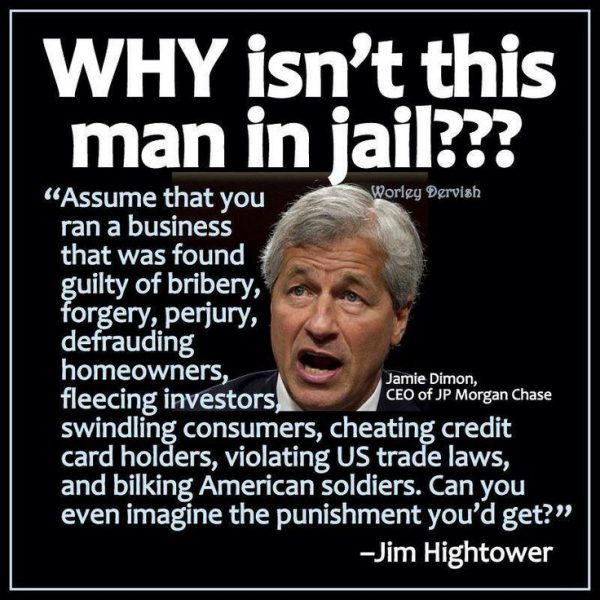

You brought to my next question very few people I think it’s around one percent control over 83% of all stocks in the publicly traded markets. We’re seeing that control happening, and I have to admit that these banksters the big Goldman Sachs, the JP Morgan Chase players of the world are very resilient. They make up new rules, and they’re playing their own game that they invent as they go.

They’re getting away with so much. Even in the housing market crisis. People saw that a year before that it was going to happen, but they were still able to hide and postpone it for a year. When it hit, they used it as an excuse to generate more revenue for themselves from the state and to get bailouts for their mistakes. All the while they were robbing everyone blind.

I do think that there is a possible future in this kind of feudalism because they’re not playing by standard economic rules. There is no way you could continue economically with so much debt and debt creation. I see the war industry as a significant transferer of wealth, especially within the Pentagon.

If you look at taxes in the United States over 80% of them, go towards defense spending. Do you see the military-industrial complex or do you see the bankers as being more responsible behind the scenes? It is the wars that are ultimately making the Empire stronger right now?

Max Keiser:

War is the greatest business of all because you make the most profits when you drop a bomb that cost 50 million dollars to make. You make money selling that weapon and when you blow up the bomb. Then you can sell another bomb. There are two industries that make a lot of money both war and prisons. That’s where you see a lot of the activities of corporate America migrating into war and in prisons.

Then there is the interest rate arbitrage or financialization games. They’re just playing balance sheet games to rent seek and extract wealth and leech money from the system. This is an interesting point because of the whole history of finance and markets. In America the point of the checks and balances of the country along with houses of government and the way that the press set up like a Fourth Estate to be another check on power. This is all meant to encourage competition.

I’m a free market proponent but what you have now is the complete absence of competition. Without competition, there can be no organic GDP growth and therefore no actual growth. Since there is no growth, there are no savings, and without savings, there’s no capital thus no capitalism. You can’t have capitalism without capital, without a rate of interest that pays people to save money. You see there’s no incentive to save money there’s only the incentive to commit fraud.

The situation is survival of the of the most fraudulently inclined. It’s a kakistocracy which is rule by the least capable of society. The root word is caca which is the word kids would say caca meaning shit. That’s the Greek preface I believe meaning ‘shit’ and it’s a shitocracy.

Luke Rudkowski:

I couldn’t agree with you more. A subject I want to discuss is Bitcoin and other alternatives since we’ve seen it enrich a lot of people. There’s are worries with Google, Goldman Sachs, and other mainstream players getting into the game. Do you think cryptocurrencies with the use of encryption and all the latest technological advancements are going to help deal with a lot of the problems with this fake economic system?

Max Keiser:

Yes, I do think it’s a solution since you have people controlling their own sovereignty and wealth under their own private keys. That property is unavailable to any regulator of any government. It’s your wealth. Unlike when you put money in the bank since the bank owns that money. You don’t have access to the money if the bank says they want it. If they want the money they’ll, have the right to take it.

We saw this with the Swift system being shut down with countries like Iran. We saw PayPal shut off for Julian Assange and WikiLeaks. They can shut down these systems at any time they want for political reasons. However, with Bitcoin, they can’t-do that.

Luke Rudkowski:

Do you think Bitcoin could be taken over by the same powers that are destroying the economic system?

Max Keiser:

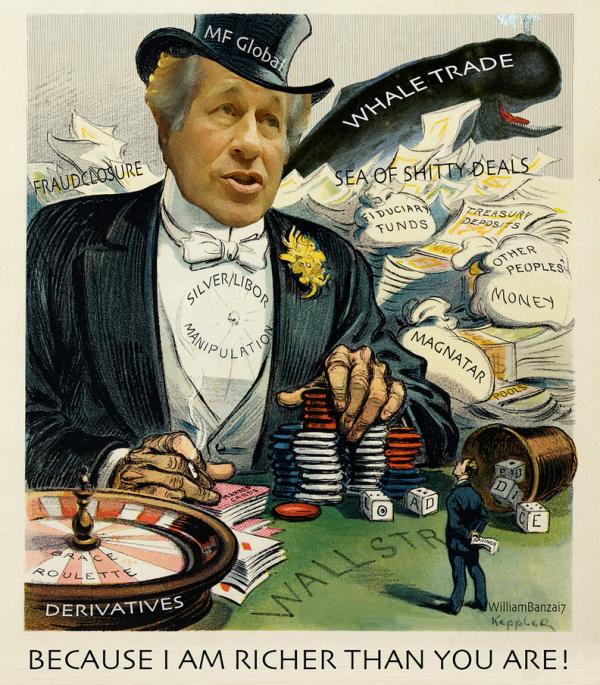

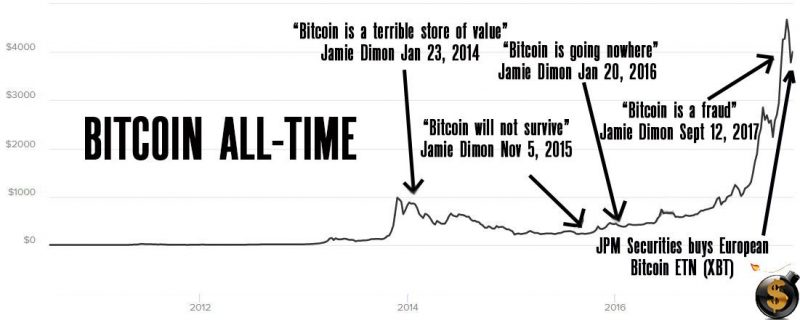

That’s why Jamie Dimon and Wall Street are freaking out. They’re saying that “Bitcoin is a fraud and that bitcoins are horrible.” You have to understand that if it were possible for Wall Street to quietly manipulate the price of Bitcoin and control it they would, and we wouldn’t hear from Jamie Dimon. He wouldn’t be screeching at the top of his lungs that this is a fraud.

It’s amusing that it’s come to this where this most powerful banker on Wall Street is reduced to shouting on the street corner. He sounds like some tin-pot street corner Jesus bible-thumper espousing the evils of Bitcoin. This is because of all the stuff that he grew up doing. His whole business model and all of his wealth have been entirely built on illegal extraction and every other underhanded Ponzi scheme dollar inflating political con game imaginable.

He’s now reaching the end with bitcoin, so I think that’s the answer. I believe that it will be resistant to the type of games that Wall Street plays.

Luke Rudkowski:

Thanks, Max you’re awesome. Thank you for your news and analysis. Check out more from Max here is the link to his RT TV Show and his website.

I want to thank all you amazing, beautiful human beings for watching and subscribing.

Stay tuned to real independent media. Love you guys.

Patreon https://www.patreon.com/WeAreChange

We gratefully accept Bitcoin too: 12HdLgeeuA87t2JU8m4tbRo247Yj5u2TVP

Donate on our site: https://wearechange.org/donate

FOLLOW WE ARE CHANGE ON SOCIAL MEDIA

SnapChat: LukeWeAreChange

Facebook: https://facebook.com/LukeWeAreChange

Twitter: https://twitter.com/Lukewearechange

Instagram: http://instagram.com/lukewearechange

Steemit: @lukewearechange

WE ARE CHANGE MERCHANDISE

Rep WeAreChange merch proudly: https://wearechange.org/store

The post Max Keiser on The Impending Feudalist Financial Kakistrophe appeared first on We Are Change.

from We Are Change https://wearechange.org/max-keiser-on-the-impending-financial-kakistrophe/

No comments:

Post a Comment